APR Calculation

Introduction

APR for each pools is a metric that indicates the expected annualized return on investment for liquidity providers. APRs are calculated differently for CL pools and normal pools due to their distinct operational mechanisms.

Concentrated Liquidity Pools

Calculation:

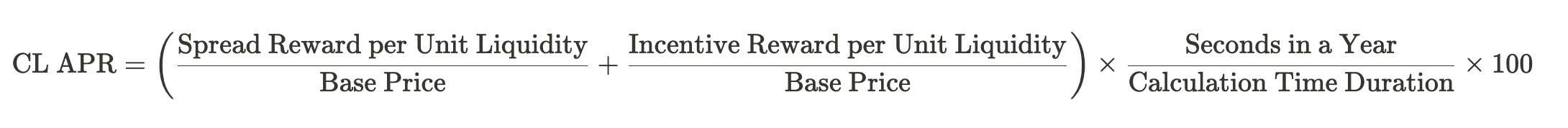

- APR for CL Pools:

Where:

Where: - Spread Reward per Unit Liquidity: This is the reward earned from the spread for providing liquidity, expressed per unit.

- Incentive Reward per Unit Liquidity: This is any additional incentive reward for providing liquidity, also expressed per unit.

- Base Price: The standardized value of one unit of liquidity in the pool, used to convert the reward values into a comparable base.

- Seconds in a Year: Represents the total number of seconds in a year, used for annualizing the return. It's calculated as ( 365.25 \times 24 \times 60 \times 60 ) to account for leap years.

- Calculation Time Duration: The duration in seconds over which the rewards were calculated

CFMM Liquidity Pools(Balancer pools, Stableswap Pools)

Standard APR Calculation (for 1 day, 7 days, and 14 days):

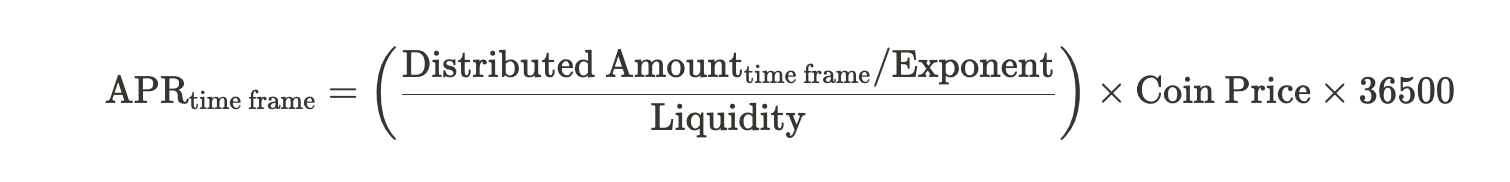

- The APR is calculated for each time frame using the formula:

- Where:

Distribured Amount_timeframeis the sum of distributed rewards for the time frame (1 day, 7 days, or 14 days).Exponentis a factor related to the coin denomination.Liquidityis the total liquidity in USD for the pool, adjusted by the percentage bonded (if applicable).Coin Priceis the current price of the coin.- The multiplier (36500) annualizes the rate.

- The APR is calculated for each time frame using the formula:

Superfluid APR Calculation (if applicable):

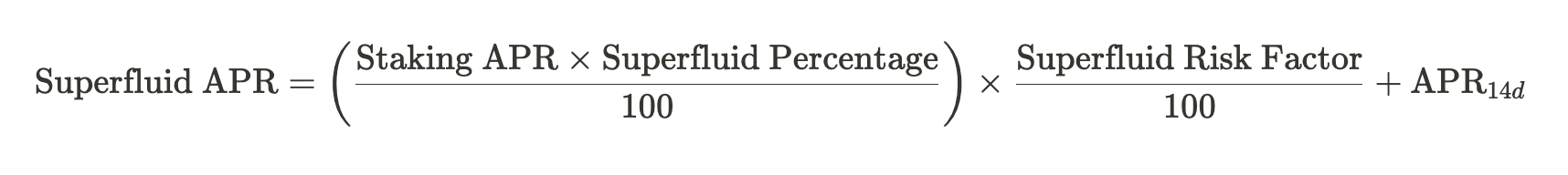

- The Superfluid APR is calculated additionally for pools where it's relevant, using the formula:

- Where:

- (\text{Staking APR}) is the APR from staking.

Superfluid Percentageis the percentage of the pool that is superfluid.Superfluid Risk Factoris a risk adjustment factor.APR_14dis the 14-day APR calculated as above.

- The Superfluid APR is calculated additionally for pools where it's relevant, using the formula: